Now that the council has stopped taking horse manure, it's piling up in the Liberties

“So the council is allowing horses in Dublin City,” says horse owner David Mulraney. “But they’re not allowing them to put their horse manure anywhere.”

If you’re not supposed to spend more than 30 percent of your income on housing, how much would you have to earn to rent a one-bedroom apartment?

We all know that rents in Dublin have risen steadily over the past few years.

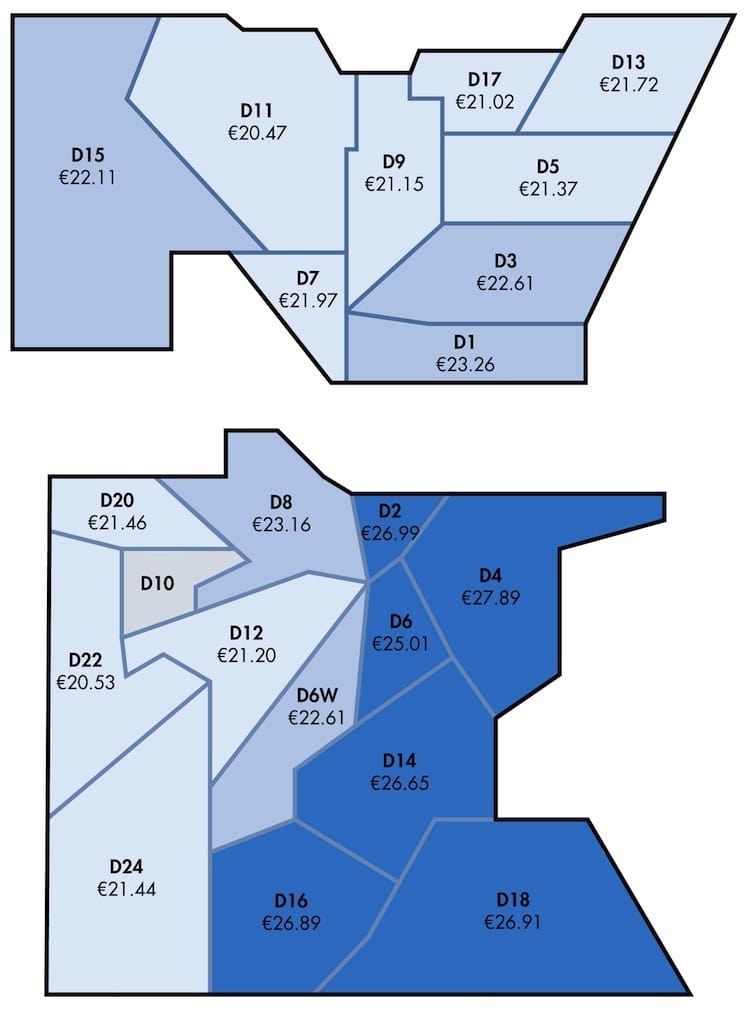

But how much, exactly, should you earn each hour to be able to pay to rent an affordable one-bedroom apartment in different parts of the city?

By “affordable” we mean it wouldn’t cost more than 30 percent of your pre-tax income.

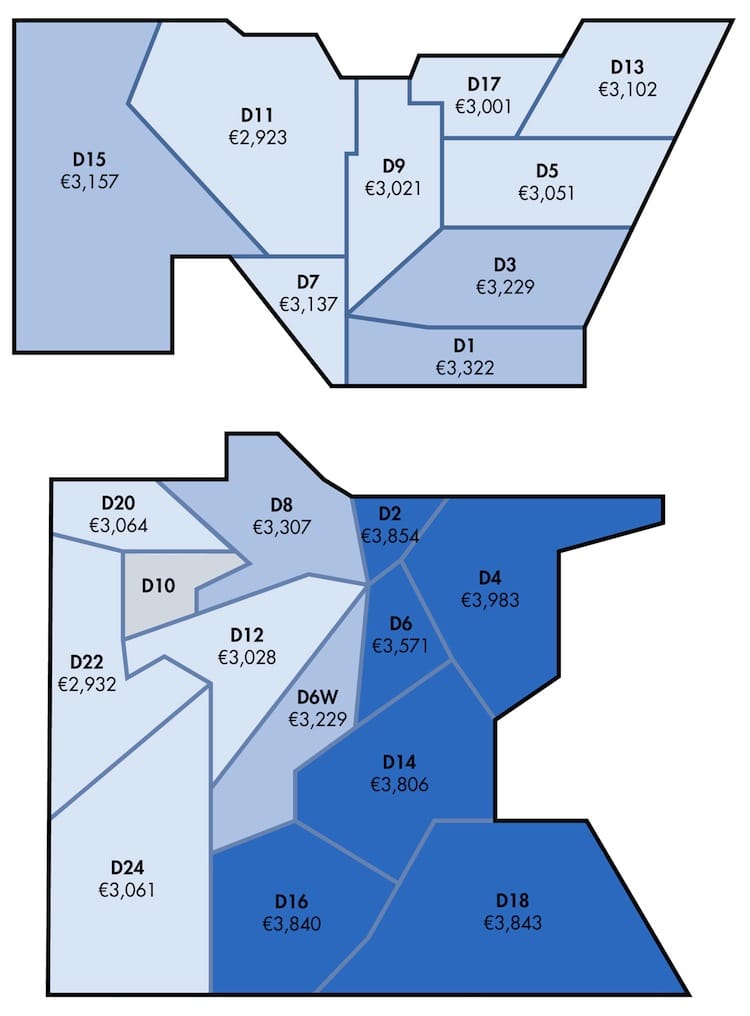

To calculate that, we took figures from the Private Residential Tenancies Board’s (PRTB’s) average rent dataset for the average rent in each postcode during the third quarter of 2015.

Then we did the maths, based on the assumption that people work 35.7 hours a week, which was the average usual hours according to data released last June by the Central Statistics Office.

Note: For D10, the figures weren’t available, and D22 is only for Clondalkin.

For some that might work.

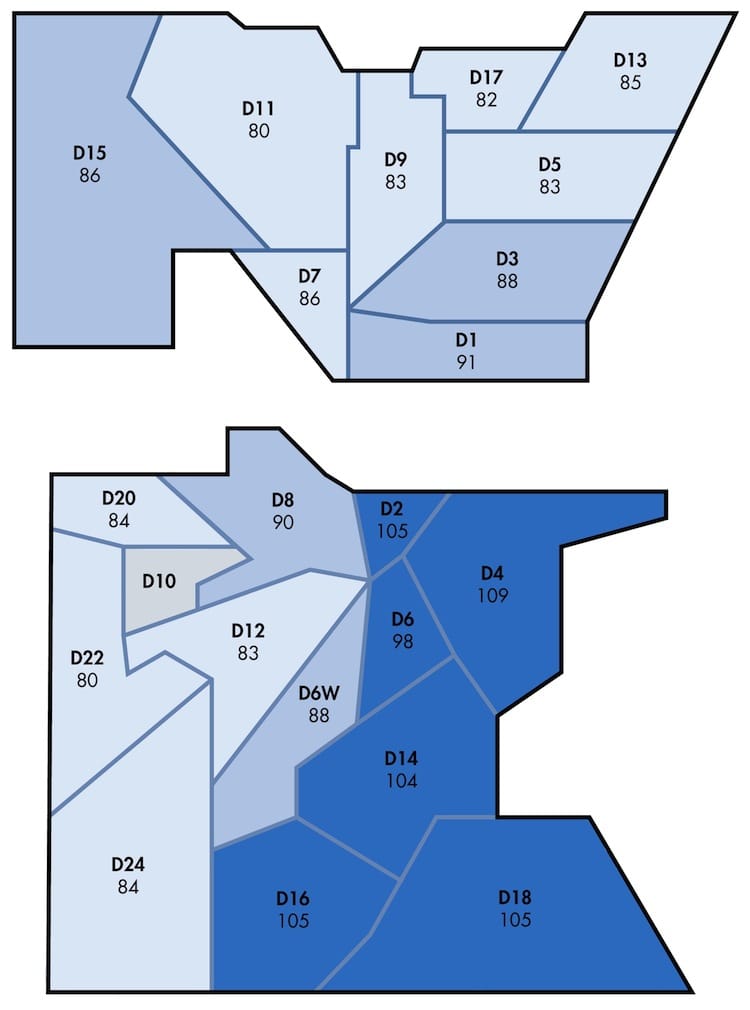

But if you’re living on minimum wage, at €9.15 per hour, and don’t have any extra supports, it would take some long, hard hours to make enough. Here’s how many hours a week you’d have to work at minimum wage to meet that 30-percent-on-rent guideline.

Top of the table: it would take 109 hours of work a week, if you wanted to rent the average one-bedroom apartment in D4, and not spend more than 30 percent of your income on it.

Opt for D11 or D22, and it would be 80 hours a week. That’s still more than double the average usual hours worked a week.

If you’re one of those people who know your monthly pre-tax pay packet, rather than your hourly wage, here’s a map to show what you’d need to bring in.